Managing the payroll setup for instructors is crucial for ensuring efficiency and accuracy in your payroll system. In this guide, we’ll walk you through the essential steps to optimize instructor payroll management, including global settings, payroll amounts, and running reports.

1. Adding Instructors to Payroll

During the payroll setup process for your instructors, you have the option to include them in the payroll system or not. If you want them listed on the payroll tab, make sure to tick the box. For instructors on salary or non-employees (e.g., a cleaning company with access to the master schedule), uncheck the box, and they will not appear in the payroll processing.

2. Setting Up Payroll Amounts for Instructors

To set up the dollar amount for instructors in your instructor payroll management system, navigate to “global settings” and then payroll in your Dance Studio Manager (DSM). Once you’ve completed this step, you can run a report to finalize the process quickly.

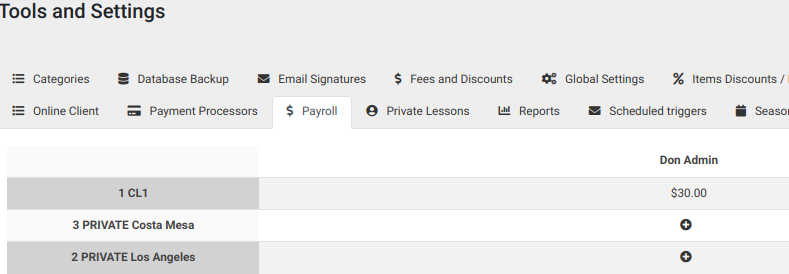

3. Configuring Payroll Settings for Each Instructor

In the payroll settings of your payroll system, each instructor will be a column, and each class will be a row. Click on the + sign or existing count, add an amount, and save. You can choose between a flat fee or hourly rate, which you’ll specify when running the payroll report.

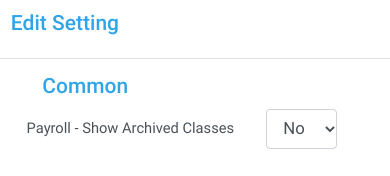

4. Managing Archived Classes in Payroll

To include archived classes in the payroll processing list, select this option under “global settings” → “common.”

5. Accessing the Payroll Report

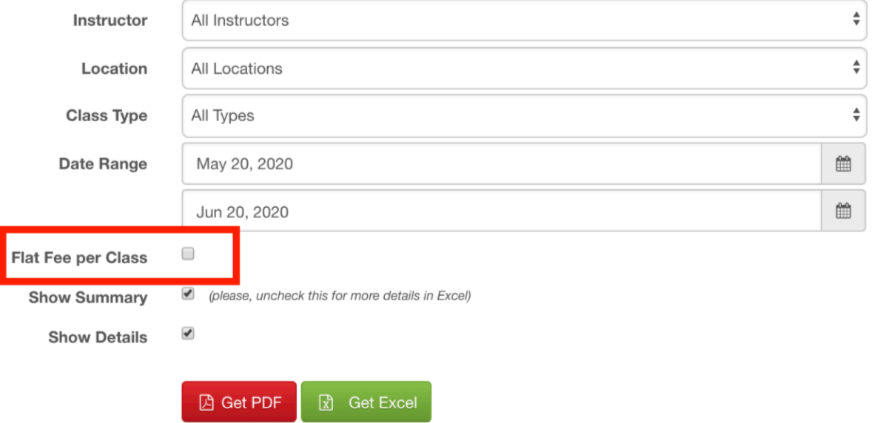

In your instructor payroll management system, select “Instructor Hours” under the “Reports” section to access the payroll report. From the dropdowns, choose a specific instructor, location, class type, and date range.

6. Understanding the Payroll Report

If the “Flat fee per class” box is NOT checked, the dollar amount entered in the “payroll settings” will be calculated as an hourly rate (e.g., $15/hour for a 2-hour class results in $30 pay). If the box IS checked, the instructor will receive a flat fee (e.g., $15) for the class.

7. Exporting the Payroll Report

Export your payroll report with summary and details in the format needed to provide the information to your payroll service.

Summary

In this guide, we’ve outlined the essential steps to optimize instructor payroll management by:

- Adding instructors to the payroll system

- Setting up payroll amounts for instructors

- Configuring payroll settings for each instructor

- Managing archived classes in payroll

- Accessing and understanding payroll reports

- Exporting payroll reports for payroll services

By following these steps, you’ll ensure efficiency and accuracy in your payroll system, effectively tracking and calculating earnings for your instructors. Remember to prioritize a positive user experience to improve your website’s SEO performance.